Market News

Commercial Due Diligence in M&A transactions

Published:2014-04-17 Source:HICG

Due Diligence (DD) refers to a comprehensive and detailed research upon the operation status of a target company in an investment/acquisition which helps the investor to assess the value and risks for the deal.

There are several kinds of Due Diligence, listed as follows:

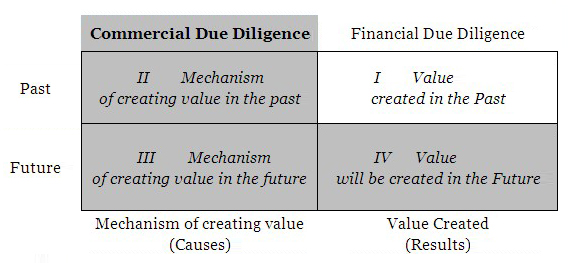

· Commercial Due Diligence for assessing the Prospect of a Business and Operational Risks

· Financial Due Diligence for assessing the Actual Assets and Liabilities

· Taxation Due Diligence for assessing the Taxation Risks

· Legal Due Diligence for assessing the Legal Risks and Litigations

· Human Resource Due Diligence for assessing the Initiatives of the Management and other Employees

· Environment Due Diligence for assessing the Pollution Conditions

· Real Estate Due Diligence for assessing the value of the premises and buildings

· And so on

Conducting a Commercial Due Diligence (CDD) is to confirm the Business Prospect of the target company. CDD reveals the market position and development tendency of a target company by analyzing the Macro Conditions, Market Status and Competition Landscape. Through the analysis of operation and management, CDD sets the primary mentalities for Post-Merger-Integration solutions and Goals of Synergies.