Market News

Relationship between commercial due diligence and other due diligence

Published:2014-05-16 Source:HICG

The purpose of commercial due diligence (CDD) is to clarify the business prospect of subject. CDD will facilitate analysts to understand the market position and development trend of subject, through analyzing the macro economy, industry size and competition environment. Meanwhile, by analyzing the internal operation management, CDD can make preparation for value enhancement and post-merge integration plan once the deal closed.

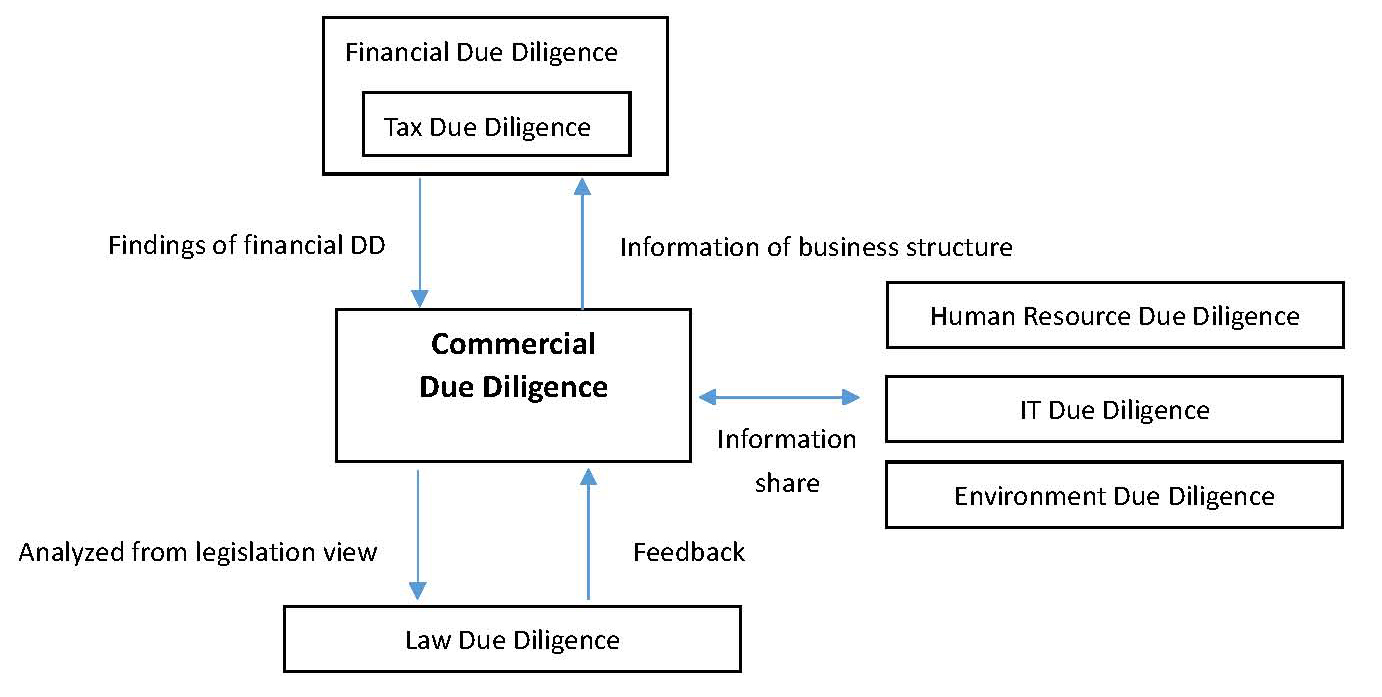

During the process of merge and acquisition, acquirer should carry out financial due diligence, law due diligence, and other necessary due diligence related to IT, HR environment and etc at the same time of CDD. Figure 1 indicates the relationship between CDD and other due diligence. The cooperation of CDD and other due diligence can be shown as following.

Firstly, findings and outcome of other due diligence may change the scope of CDD. It is necessary for these different teams to discuss issues in time to ensure response and solutions. Secondly, findings and outcome of other due diligence may affect adjustments of CDD materially. At this moment, CDD team must contact with other relative due diligence team in order to obtain updated information and documents soon.